Overview

B2B market research focuses on gaining a deep understanding of how businesses sell goods or services to other businesses in order to inform product development or marketing strategy. Compared to more traditional consumer research, the B2B decision-making process is often more considered and may involve multiple stakeholders. In B2B, the value chain is typically longer, the seller and buyer may continue to interact long after finalizing the sale, and B2B products and services themselves are often more complex.

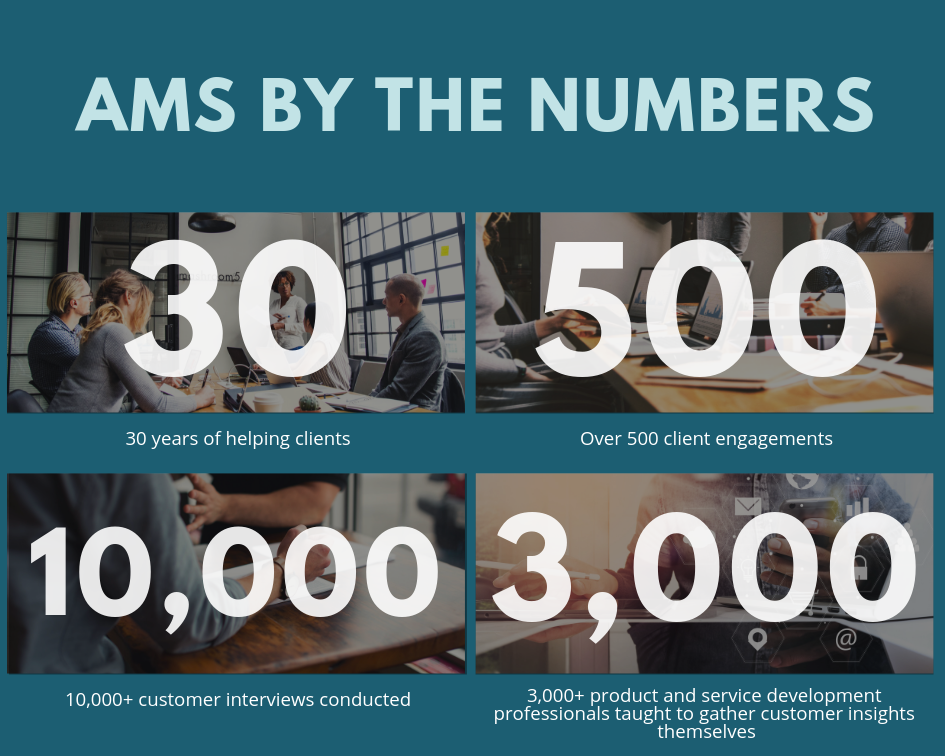

Applied Marketing Science, a full-service custom research firm with an international reach, has more than 30 years of experience conducting high quality market research, training and consulting to help B2B companies successfully develop and launch new products and services.

B2B market research can help you:

- Find your competitive advantage

- Decide where to focus your innovation efforts

- Optimize customer experience

- Benchmark your strengths and weaknesses vs. competitors

- Understand how and why customers decide who to do business with

- Measure customer loyalty and value

- Uncover promising new markets and adjacencies

- Formulate effective value propositions and market messaging

- Size the market

- Measure demand and willingness to pay

Industry Expertise

We Have Deep Domain Knowledge

B2B products and services are typically much more complex than B2C goods. We’ve helped clients in dozens of industries, and we already understand many B2B products. We’re able to draw on our past experiences to help us quickly learn about new products, so we can talk about them intelligently with your customers.

Below is a sampling of B2B industries, products and audiences we've served and researched.

.png)

We Recruit Hard-to-Find Respondents

It’s not easy to recruit B2B audiences. Your customers may spend more time in a shop or on a plant floor than by a computer or office phone, and you likely sell to several people in the value chain – suppliers, distributors, influencers, users, managers, maintenance, and so on. Plus, your company may serve customers in diverse geographies around the world, and you need to understand each of their unique challenges.

Over the last three decades, we've cultivated strong relationships with recruiters around the world. Our global partners help us find top notch respondents in any industry, who can provide you with the information you need to understand your market better. Our recruiters are skilled at both sourcing their own names and recruiting off your customer lists.

We Have Global Experience

We have experience conducting research in B2B markets around the world, including North America, Europe, Asia, Australia, and Africa. We understand how to tailor interviews and surveys so they’re appropriate for respondents across the globe.

We Are Expert Interviewers

Our interviewers know how to speak your customers’ language. We know how to build rapport and gather insights from anyone in your B2B value chain. In fact, we have years of experience talking with everyone from line workers to CEOs and presidents of major companies.

We Lead Site Visits

Your customers may use your products and services in their own complex processes. In these cases, we often recommend conducting at least some site visits, so we can watch your customers work and ask them questions about their processes. By using site visits, we’re able to uncover insights that may not have come up during a typical interview.

Our clients trust us to lead site visits with their most important customers. We know how to gather the information we need to help you develop new products and services, while also protecting and even enhancing your most important relationships.

B2B Market Research FAQs

AMS designs and implements market research studies to answer your toughest questions, including:

Q: Where should I innovate next? How can I disrupt the market?

We specialize in using Voice of the Customer (VOC) research methods to help you during the “fuzzy front end” of innovation, when you’re first developing new ideas and concepts. In fact, our co-founder, John Hauser of MIT Sloan School, and Abby Griffin, of the University of Utah, invented VOC when they published their article “Voice of the Customer” in 1993 in Marketing Science, a leading peer-reviewed academic journal.

Our VOC method has two main parts. First, we use qualitative interviews and site visits to uncover a comprehensive list of customer wants and needs. Then, we use surveys to understand how current and prospective customers rate the importance and performance of each need. Ultimately, we’re able to identify clear focus areas, as well as hidden opportunities, to disrupt the market place.

Q: How can I create an offering that appeals to the entire value chain?

Our VOC method helps you understand the wants and needs of everyone in your value chain – not just those in one or two roles. At the beginning of your project, we’ll work with you to decide who should be included in our study. Common respondent types include decision makers, users, dealer, distributors, and others. We typically include respondents from diverse geographies and a mix of current and prospective customers.

Q: How can I turn my customers’ unmet needs into a product or service offering?

We have years of experience moderating Quality Function Deployment (QFD) sessions to translate customers’ unmet wants and needs into clear product and service offerings. QFD sessions typically take place on-site over 1 or 2 days. By the end of the exercise, you’ll have a Minimum Viable Product (MVP) and clear steps for developing your next product or service.

Q: Will my customers like my new product or service offering? Should I make any changes before launching?

After you’ve fleshed out your product or service offering, we conduct concept tests with current and potential customers to determine what changes, if any, you should make before bringing your product or service to market. We typically use focus groups or in-person interviews to conduct concept tests, but if your customers are spread around the world or difficult to reach, we can also conduct them online.

Q: How should I price my new product or service offering? How much are customers willing to pay for enhancements or upgrades?

It’s extremely difficult to get pricing right. Price things too high, and no one will buy. Too low, and you’ve lost out on profits. At AMS, we have world-renowned pricing experts on staff, with decades of experience with conjoint and other choice-based methodologies. We can help you determine what your customers are willing to pay for your entire product or for specific features and enhancement. We can help set your pricing strategy so that you maximize profits and prevail over competitors.

Q: How do I uncover latent or unstated needs?

Often, we include ethnographies or site visits as part of our Voice of the Customer (VOC) process. Watching customers do their work using your product (or a competitor’s) gives us a better understanding of their problems and pain points. It also allows us to uncover their latent or unstated needs – things that may not come up during an interview, but that are apparent when we meet at a worksite. For example, during our ethnographies, we often notice customers using products differently than intended. By probing on why, we can develop a richer understanding of customers’ less obvious needs.

Q: How can I improve my customers’ experiences with my product or service?

At AMS, we specialize in understanding your current and prospective customers’ experiences with products and services. Using our journey mapping methodology, we can help you understand your customers’ needs, tasks, and touchpoints throughout their decision-making process – from awareness through purchase and usage over time. Journey mapping can be especially helpful for B2B companies who primarily sell commodities. If there are few ways that you can innovate around the product itself, it’s time to think about ways you can improve your customers’ decision-making journey.

Q: How can I make sense of what my customers are saying about me or my category online?

Although it’s often more common for consumer products, some of our B2B clients have a user base that’s active on online forums, sharing their opinions on what’s working well or poorly about a product category. At AMS, our machine learning offering helps you distill large volumes of open-ended responses into the needs that matter most. Machine learning is especially helpful for uncovering nuanced needs that may not surface through traditional qualitative methods. As with needs uncovered during interviews or site visits, we can use follow-up surveys to prioritize these needs and develop actionable insights.

B2B Research Training

We offer a host of interactive workshops to train your team in our research methods. Thousands of people from dozens of B2B companies have been through our 2-day flagship course, Listening to the Voice of the Customer. Other popular courses include Customer Interviewing and Ethnography and Journey Mapping and the Customer Experience.

We offer our training in three formats:

Private In-House Training

In this format, we teach courses at your company, and we can typically accommodate between 8 and 30 attendees. Because we’re training only those at your company, we can tailor all our examples and exercises to your industry.

Public Training

We typically hold public training sessions 2-3 times per year in different cities around the United States. Attendees from all companies and industries are welcome. This is a great opportunity to learn new skills and network with others interested in market research. Many also attend to help them decide whether to bring the training in-house.

Training and Coaching

Sometimes, clients are interested in implementing our methods throughout their organization, but need help developing their internal expertise. We train your company in our methods, then provide one-on-one coaching as you use our methods to implement a real research project.

To learn more about any of our Training and Coaching offerings, visit our Customer Insights Training and Coaching page.

Additional Resources

Case Studies

Engineered Products and Components- An industrial pump manufacturer innovates with VOC NavigatorTM

- Engineered products provider differentiates itself in a commoditized market

- Leading industrial components company discovers a game-changing unmet needs

- Machine learning uncovers key insights for snow removal

- John Deere partners with AMS to develop next generation products

Chemicals, Coatings and Additives

Banking, Investing and Insurance

- Major health insurance provider identifies actionable, needs-based segments

- US health insurance provider uses customer experience to improve retention

- Journey mapping as a tool to transform patient experience

- A leading medical device manufacturer transforms its product development strategy

- How a simulator manufacturer revolutionized medical training

- How a medical device manufacturer used VOC to revitalize a failing product

- The Gates Foundation uses ethnography to inform immunization research

Blog Posts

- The Top 3 Innovation Mistakes in Industrial Markets

- Does Your Company Need a Voice of the Customer Survey?

- The Power of Patient Journey Maps

- Three Ways to Create Markets and Succeed in the Industrial Internet of Things

- Voice of the Customer for Successful Innovation in Commoditized Markets

- Recruiting Hard to Reach Respondents for Voice of the Customer Research

Webinars On-Demand

- Voice of the Customer for Product Managers

- Using Journey Maps to Transform the Customer Experience

- Voice of the Customer Research: Fact vs. Fiction

- Creating Markets: Succeeding in the Industrial Internet of Things

- When Nothing Ever Changes: Innovating in Commoditized Markets

- Find the Ah-Ha's: Uncovering Actionable Qualitative Insights

Videos